Investire | December 2020

Three years ago, very few people talked about ESG. What used to sound as an enigmatic acronym, today has become the holy mantra of the asset management and financial consultancy industry, the quickest to recognize a phenomenon of growing importance.

Four key factors are going to determine the longevity of the success of ESG investing.

The first corresponds to the awareness and propensity of savers towards funds that include ESG factors. Numbers suggest that today ESG awareness is on the rise.

ESG awareness in Italy – especially in the larger segments of Italian savers – has increased drastically between 2018 and 2020. + 20% among small and medium investors; + 13% among private and HNW clients, who were already much more informed on the subject (source: survey carried out in 2018 by FINER for ASSOGESTIONI on the occasion of Salone del Risparmio).

Similarly to many other mass phenomena, ESG awareness originated from elites, which work as opinion leaders or early adopters and tend to be better educated and better capitalized. Only afterwards did it spread among the rest of the population.

The second factor is connected to the proactivity of financial advisors, private bankers and bank managers.

In fact, in a market driven by supply, the client’s awareness alone is not sufficient to kick-start ESG investing. This takes the active work of the distribution system.

In 2018, 66% of financial advisors introduced ESG to their clients. However, only 22% of them remembered the content, only to show how ineffective and possibly unconvincing the FAs’ commercial position was.

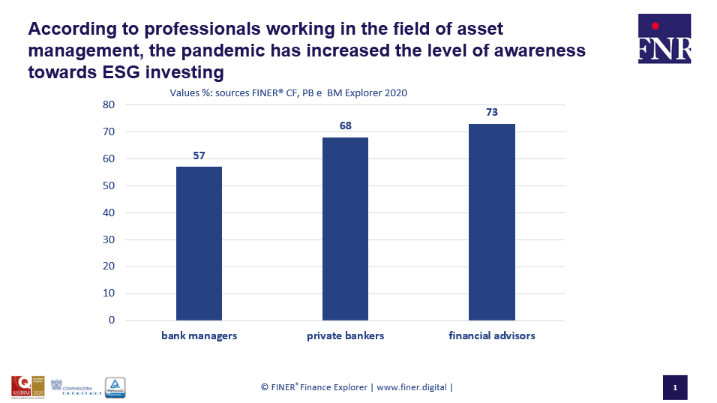

Today, after three years, the picture has completely changed. All financial professionals agree that climate change, social inequalities as well as the pandemic have increased the level of awareness of their clients (see picture 1).

During the market crash following the beginning of the pandemic, funds including ESG factors performed better than traditional ones – therefore, it is more and more evident to investors and savers that sustainability and resilience go hand in hand.

He third factor is linked to the credibility of those who manage and suggest ESG investments. Today, all AMCs compete with each other and shout from the rooftops about their ESG compliance.

However, due to the lack of clear taxonomy or official certificates, only those who advertise their ESG compliance in the best and most convincing way tend to acquire competitive advantage.

The fourth factor rests on a fundamental assumption: ESG is not an asset class, but a prerequisite for any type of investment, be it an ETF, an equity fund, a bond fund or balanced fund.

In other words, despite the initial enthusiasm for ESG investing, the success of a fund or an AMC still depends on their ability to generate value for the end investor. So, ESG is going to be the new playing field; however, rules will be the same as in the past.

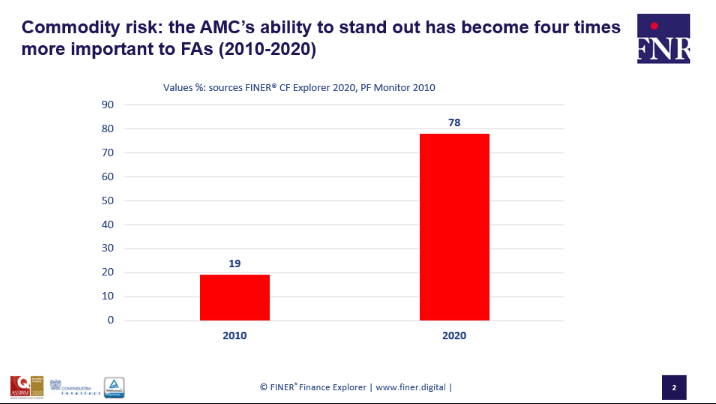

In this respect, it is worth remembering that the industry of asset management is exposed to the commodity risk. Indeed, according to financial advisors, private bankers, bank managers and their clients, very few AMCs suggest unique and recognizable products each with their own brand equity; in other words, products that exceed performance, which is not sufficient to stand out among thousands of funds and hundreds of asset managers (see picture 2).

We may say that ESG is like a surname: any self-respecting asset manager should add its own name and distinguishing features to it.

Several AMCs are well aware of the implications of the challenge: some of them are working in the right direction, most of them seems to be still sailing in charted waters.

Nicola Ronchetti