Investire | November 2020

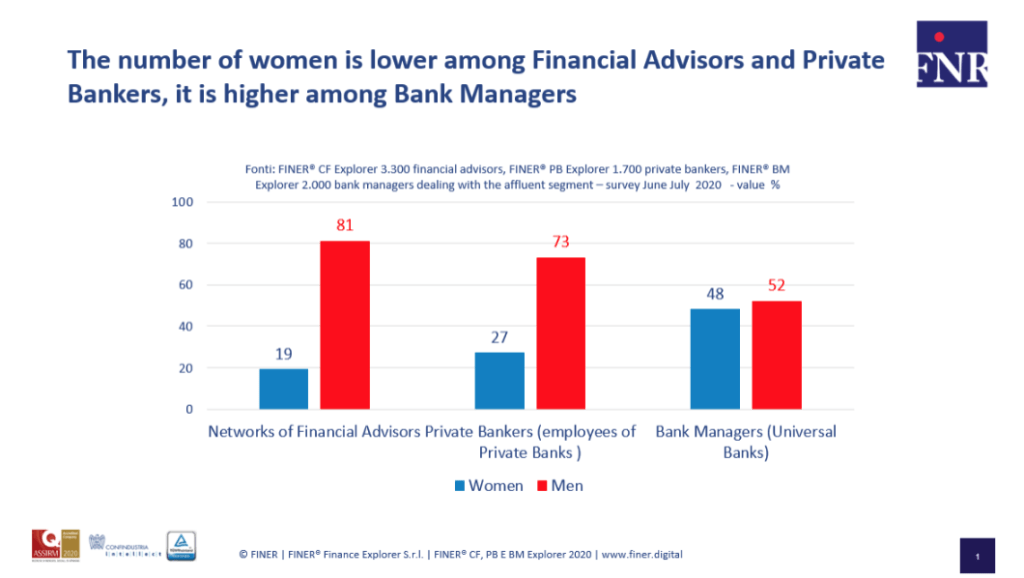

Every year FINER conducts three monitoring surveys on three categories of financial professionals: 3.300 Financial Advisors (CF Explorer), 1.700 Private Bankers (PB Explorer) and 2.000 Bank Managers who deal with affluent clients (BM Explorers). Here is the percentage of women in each category: 19% Financial Advisors, 27% Private Bankers and 48% Bank Managers.

To each category corresponds a different service model – networks, private banks and universal banks – with two different figures: agents and employees.

The type of client is also different: networks of financial advisors assist upper affluent or low private clients with assets ranging from 200.000 to 1 million euros; Private Banks assist clients with assets ranging from 500.000 to 2 million euros or more; dedicated bank managers assist affluent clients with assets ranging from 50.000 to 200.000 euros.

While financial networks specialize in asset management and digital operations, private banks have always been the main interlocutor of entrepreneurs and ensure access to credit to their business. Universal banks are characterized by their local presence and offer a wide range of services, from mortgages and loans, to asset management and insurance products.

A comparison between women and men offers interesting insights. Women are a minority among financial advisors and private bankers and about half the number of managers.

Female employees show a lower level of satisfaction with remuneration than their male colleagues. The difference is especially evident between female and male private bankers. However, it is also quite significant among bank managers – on average, men are more satisfied with the variable component of remuneration, while women favour the welfare of the company.

As for financial advisors, the gender discrepancy is meaningful in connection with a series of issues: women seem more satisfied than men with the level of attention, marketing support, products, operations, engagement of banks/networks.

Even during the (first) lockdown, female financial advisors showed higher levels of satisfaction with the support received from banks/networks and managers.

Moreover, there is a very important difference in the loyalty towards networks/banks shown by men and women in the medium to long term (5 years): female financial advisors and bank employees who assist affluent clients appear to be more loyal to their bank/network than their male colleagues.

With regard to private bankers, women show a higher level of satisfaction than their male colleagues with optional services linked to investment management, especially those connected to wealth management, tax system, inheritance, club deal, private insurance, corporate finance.

In conclusion, female professionals of wealth management – whether agents or employees – are on average more satisfied with services and products, less satisfied with remuneration, yet more loyal.

Women seem more open-minded even when offering services with a higher added value. They show less stress triggered by performance anxiety and client acquisition; as a consequence, in their clients’ eyes, they look calmer, yet equally determined as their male colleagues, more discrete and protective.

It is no accident that the presence of women is increasing in many successful environments.

Nicola Ronchetti