Investire | March 2021

In spite of this time of zero rates, networks of financial advisors have recently closed their best year of all time with a positive balance worth 43,4 billion euros (+24,1% compared to 2019, source: ASSORETI).

In 2020, the industry of asset management, supported mostly by financial networks, collected a total of 14,57 billion euros. This set a new record, with the generation of 2.421,5 billion euros in managed assets (source: ASSOGESTIONI).

However, financial networks are currently dealing with net liquidity assets worth 12,4 billion euros on current accounts and deposits, even though they have recorded a bending of 4% compared to 2019 (source: ASSORETI).

Always on the lookout for positive rates, some of the players of financial consultancy have been promoting illiquid investments in real economy, which consist for the most part in investments in stocks and bonds of unlisted companies.

Illiquid investments have always been a prerogative of a small elite of investors (mostly HNWIs) with access tickets worth several million euros. But some financial networks aim at democratizing this kind of investment.

The central issue is finding investable and unlisted companies. Indeed, the field of private equity cannot be approached carelessly, characterized as it is by a high risk-return ratio.

There are two main possible options: buying, that is distributing illiquid products made by major Italian and international players; or making, that is making illiquid products at home.

In fact, specialists in private equity can offer products that are the result of years of experience and oftentimes with considerable economies of scale; moreover, they are able to supply several banks/networks at the same time, even when they are in competition with one another.

On the other hand, the homemaking choice enhances the internal control of the selection of investable companies, it assures proponents greater flexibility, and allows to retain control of both revenues and costs. The only delicate point is skills and track record – in fact, homemaking means counting on the best professionals of the financial field.

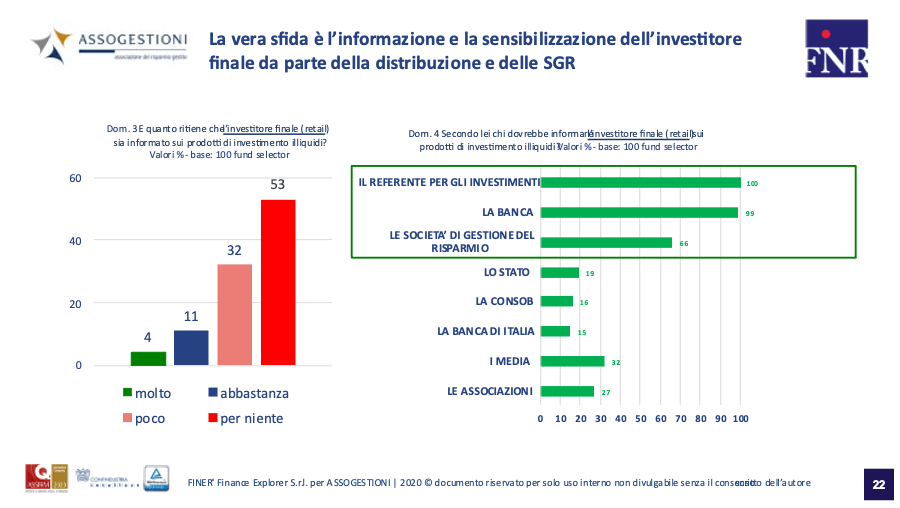

However, fund selectors – that is, those who select products for financial networks and banks – are aware that the knowledge on illiquid products among retail investors is still quite poor (source: ASSOGESTIONI).

Whether the choice falls on specialists or on homemaking, what matters is stating clearly that illiquid investments require a long time horizon and have a high risk-return ratio; otherwise, this will negatively affect real economy (family and enterprises).

Nicola Ronchetti